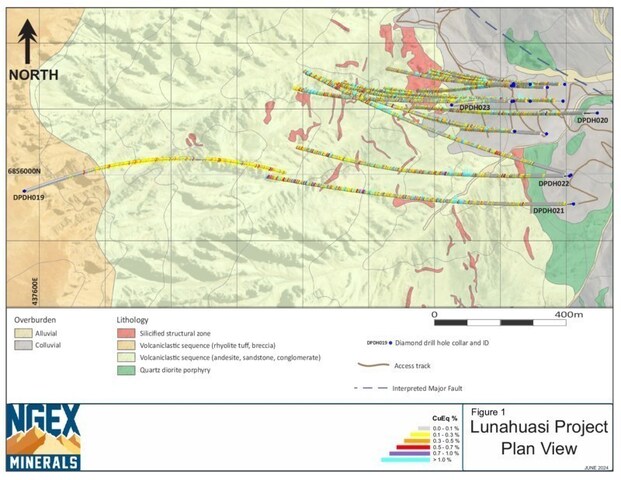

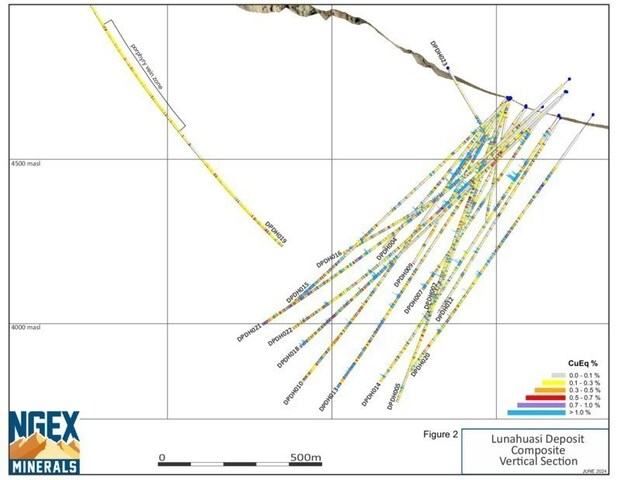

VANCOUVER, BC, June 19, 2024 /CNW/ – NGEx Minerals Ltd. ("NGEx", "NGEx Minerals" or the "Company") (TSX: NGEX) (OTCQX: NGXXF) is pleased to report drill results from holes DPDH019 through DPDH023 from the Lunahuasi Project located in the Vicuña District in San Juan Province, Argentina. These results conclude a very successful 2023 – 2024 drill program that has begun to outline a very large volume of altered and mineralized rock characterized by stockwork and disseminated mineralization, increasing in intensity from east to west and with depth, cut by a swarm of mineralized structures consisting of breccias, networks of veinlets, and massive sulphide veins which occur throughout the entire volume drilled to date. These structures contain bonanza-grade copper, gold and silver values. Drilling to date has intersected mineralization across a minimum east-west distance of 900m, along a minimum north-south distance of 400m and at least 960m vertically and this volume remains open in all directions. View PDF

Wojtek Wodzicki, President and CEO, commented, "These latest results cap off a remarkably successful drill program at Lunahuasi, which continues to surprise to the upside and to deliver some of the highest-grade copper, gold, silver intercepts globally and is now beginning to demonstrate meaningful size potential in addition to very high grades. Drilling this season has significantly expanded the mineralized volume which remains open in all directions with most holes ending in good grade material. With cash and short-term investments of approximately $49 million currently, the Company is well-positioned to continue to expand what is shaping up to be a large and high-grade deposit in a district that is demonstrating globally significant scale."

The Company will host webinars on June 19 and June 21, 2024, to discuss the Lunahuasi drill results and provide a general corporate update. For details on the webinars, please refer to the "Upcoming Webinars" section of this news release.

Highlights

- Drillhole DPDH020 intersected 750.1m at 1.13% CuEq from 204.0m, including:

- 17.3m at 5.94% CuEq from 589.8m

- Drillhole DPDH021 intersected 772.5m at 1.60% CuEq from 430.0m, including:

- 58.1m at 6.04% CuEq from 438.0m

- Including 20.1m at 15.05% CuEq from 476.0m which included

- 4.8m at 41.12% CuEq from 480.5m

- 6.0m at 19.62% CuEq from 614.0m

- 7.1m at 9.57% CuEq from 810.0m

- Extends the strike length of the Lunahuasi Deposit to at least 400m

- 58.1m at 6.04% CuEq from 438.0m

- Drillhole DPDH022 intersected 726.5m at 1.66% CuEq from 380.0m, including:

- 157.0m at 4.37% CuEq from 380.0m which included

- 38.9m at 10.04 g/t Au from 408.0m

- 9.3m at 11.61% CuEq from 492.7m

- 5.8m at 8.73% CuEq from 807.0m

- 9.6m at 10.08% CuEq from 972.5m

- 157.0m at 4.37% CuEq from 380.0m which included

- Drillhole DPDH023 intersected 85.0m at 2.87% CuEq from 169.0m, including:

- 10.1m at 4.65% CuEq from 184.0m

- 6.0m at 12.39% CuEq from 248.0m

Intersection details, including estimated true widths, are shown below. Additional maps and figures of Lunahuasi are attached to the end of this news release.

Table 1: Drill Hole Intercepts

|

Hole ID |

From (m) |

To (m) |

Length (m) |

Est True |

Cu (%) |

Au (g/t) |

Ag (g/t) |

CuEq (%) |

|

DPDH017 |

No Significant Results |

|||||||

|

DPDH019 |

524.0 |

538.0 |

14.0 |

7.5 |

0.24 |

0.29 |

8.8 |

0.53 |

|

plus |

968.0 |

974.0 |

6.0 |

4.0 |

0.28 |

0.53 |

22.7 |

0.87 |

|

plus |

1,088.0 |

1,098.0 |

10.0 |

7.0 |

0.27 |

0.33 |

3.6 |

0.55 |

|

plus |

1,184.0 |

1,200.0 |

16.0 |

12.0 |

0.38 |

0.21 |

6.9 |

0.59 |

|

plus |

1,270.0 |

1,338.0 |

68.0 |

52.0 |

0.21 |

0.22 |

17.2 |

0.52 |

|

plus |

1,362.0 |

1,391.6 |

29.6 |

23.0 |

0.37 |

0.21 |

5.1 |

0.57 |

|

DPDH020 |

204.0 |

954.1 |

750.1 |

360.0 |

0.74 |

0.38 |

11.9 |

1.13 |

|

incl |

268.0 |

276.0 |

8.0 |

4.0 |

1.26 |

2.27 |

10.3 |

3.01 |

|

and incl |

439.0 |

443.0 |

4.0 |

2.0 |

4.34 |

1.17 |

16.0 |

5.33 |

|

and incl |

498.5 |

501.4 |

2.9 |

2.0 |

7.76 |

1.25 |

20.3 |

8.85 |

|

and incl |

589.8 |

607.1 |

17.3 |

8.0 |

4.87 |

0.72 |

61.0 |

5.94 |

|

and incl |

660.5 |

661.5 |

1.0 |

0.5 |

20.77 |

3.25 |

198.0 |

24.88 |

|

and incl |

742.5 |

753.4 |

10.9 |

6.0 |

3.45 |

0.94 |

18.3 |

4.30 |

|

and incl |

802.5 |

810.5 |

8.0 |

4.0 |

6.74 |

2.16 |

55.4 |

8.81 |

|

DPDH021 |

430.0 |

1,202.5 |

772.5 |

564.0 |

1.02 |

0.64 |

14.2 |

1.60 |

|

incl |

438.0 |

496.1 |

58.1 |

38.0 |

3.53 |

2.76 |

56.3 |

6.04 |

|

incl |

476.0 |

496.1 |

20.1 |

13.0 |

9.18 |

6.86 |

98.5 |

15.05 |

|

incl |

480.5 |

485.3 |

4.8 |

3.0 |

20.97 |

24.34 |

272.1 |

41.12 |

|

and incl |

527.7 |

530.5 |

2.8 |

2.0 |

3.97 |

9.09 |

33.6 |

10.90 |

|

and incl |

549.9 |

556.0 |

6.1 |

4.0 |

3.41 |

1.21 |

41.3 |

4.66 |

|

and incl |

589.0 |

622.2 |

33.2 |

23.0 |

3.45 |

1.21 |

42.8 |

4.71 |

|

incl |

598.0 |

601.0 |

3.0 |

2.0 |

5.07 |

2.22 |

90.4 |

7.48 |

|

incl |

614.0 |

620.0 |

6.0 |

4.0 |

15.09 |

4.27 |

160.7 |

19.62 |

|

and incl |

644.3 |

656.6 |

12.4 |

9.0 |

2.83 |

2.12 |

51.5 |

4.83 |

|

incl |

810.0 |

817.2 |

7.1 |

5.0 |

6.68 |

2.64 |

110.2 |

9.57 |

|

incl |

910.6 |

918.7 |

8.2 |

6.0 |

2.53 |

0.88 |

22.0 |

3.37 |

|

incl |

970.0 |

975.3 |

5.3 |

4.0 |

0.97 |

4.10 |

11.2 |

4.05 |

|

incl |

1,147.8 |

1,157.7 |

9.9 |

8.0 |

2.62 |

0.41 |

13.2 |

3.04 |

|

Hole ID |

From (m) |

To (m) |

Length (m) |

Est True |

Cu (%) |

Au (g/t) |

Ag (g/t) |

CuEq (%) |

|

DPDH022 |

178.0 |

186.0 |

8.0 |

5.0 |

0.13 |

0.95 |

21.5 |

1.01 |

|

plus |

235.0 |

244.0 |

9.0 |

6.0 |

0.31 |

0.87 |

18.5 |

1.10 |

|

plus |

264.0 |

275.7 |

11.7 |

7.0 |

0.62 |

0.65 |

12.0 |

1.20 |

|

plus |

380.0 |

1,106.5 |

726.5 |

503.0 |

0.89 |

0.88 |

14.5 |

1.66 |

|

incl |

380.0 |

537.0 |

157.0 |

100.0 |

1.86 |

3.03 |

33.6 |

4.37 |

|

incl |

408.0 |

446.9 |

38.9 |

25.0 |

2.92 |

10.04 |

67.7 |

10.84 |

|

incl |

492.7 |

502.0 |

9.3 |

6.0 |

7.97 |

3.39 |

132.9 |

11.61 |

|

incl |

521.7 |

523.0 |

1.3 |

1.0 |

17.68 |

3.04 |

103.0 |

20.80 |

|

and incl |

807.0 |

812.8 |

5.8 |

4.0 |

6.40 |

2.13 |

87.4 |

8.73 |

|

and incl |

972.5 |

982.1 |

9.6 |

7.0 |

6.40 |

3.25 |

149.5 |

10.08 |

|

and incl |

1,062.6 |

1,074.7 |

12.1 |

9.0 |

3.82 |

0.59 |

25.2 |

4.48 |

|

DPDH023 |

169.0 |

254.0 |

85.0 |

46.0 |

1.57 |

1.32 |

38.8 |

2.87 |

|

incl |

175.0 |

177.4 |

2.4 |

1.3 |

3.59 |

2.30 |

118.6 |

6.31 |

|

and incl |

184.0 |

194.1 |

10.1 |

6.0 |

2.44 |

2.46 |

46.4 |

4.65 |

|

and incl |

215.0 |

224.0 |

9.0 |

5.0 |

2.48 |

2.12 |

72.1 |

4.66 |

|

and incl |

235.0 |

238.7 |

3.7 |

2.0 |

6.79 |

2.44 |

159.8 |

9.98 |

|

and incl |

248.0 |

254.0 |

6.0 |

3.0 |

7.30 |

5.51 |

122.2 |

12.39 |

|

CuEq for drill intersections is calculated based on US$3.00/lb Cu, US$1,500/oz Au and US$18/oz Ag, with 80% metallurgical recoveries assumed for all metals. The formula is: CuEq % = Cu % + (0.7292 * Au g/t) + (0.0088 * Ag g/t). True widths are estimated based on a preliminary geological interpretation and are subject to change as more information is acquired and the geological interpretation is refined. |

2023 – 2024 Drill Program Summary

Drilling this season has vastly improved our understanding of the key features of the Lunahuasi system and has begun to outline a very large volume of altered and mineralized rock which displays two distinct styles of mineralization stockwork and disseminated mineralization overprinted by high-grade structures. The entire rock mass shows an increase in alteration intensity from east to west from propylitic alteration typical of the outer halo of a porphyry system in the east to intense quartz-clay (argillic) alteration typical of more proximal but still not central alteration. With the transition to higher temperature, more proximal alteration there is a corresponding increase in intensity of stockwork and disseminated mineralization and pervasive disseminated copper-gold-silver mineralization cut by a stockwork of pyrite-enargite veinlets in the west. All holes drilled to date end in this style of mineralization.

This entire package of rock is then cut by a swarm of bonanza-grade structures consisting of breccias, networks of veinlets and massive sulphide veins which occur uniformly throughout the entire volume drilled to date. These veins contain extremely high copper, gold and silver values and occur across an east-west distance of at least 900m, along a north-south distance of at least 400m and extend at least 960m vertically, and this volume remains open in all directions. With the current drill spacing we are not yet able to confirm correlation of individual intersections, however these structures appear to strike north to north-northeast (000 to 020) and dip sub-vertically. This strike direction is consistent with the main regional-scale structural corridor which controls the Filo del Sol deposit located six kilometres to the south and continues through to the Los Helados deposit located nine kilometres to the north. This structural corridor, which is approximately one kilometre wide, passes through the Lunahuasi deposit and is a logical control on the mineralization.

Based on analogy to similar deposits it is likely that, at the deposit scale, the mineralized bonanza-grade structures will demonstrate pinch-and-swell geometries, well-defined ore shoots and will bifurcate and display local changes in strike and dip. Detailed drilling and eventual underground development will be required to fully understand the geometry and continuity of the bonanza-grade structures, but the number of individual intersections and the widths and grades encountered to date provide clear evidence of the potential for a very large-scale, high-grade deposit. The broader intervals of stockwork and disseminated mineralization are less structurally controlled and are likely to allow for wider spaced drilling.

On a broader scale, the increase in background alteration and mineralization from east to west provides a vector towards a porphyry centre which is the source of the mineralization. Additional evidence for the presence and location of this centre was provided by DPDH019 as described above. The pattern of alteration and mineralization encountered to date is consistent with the zonation created by a porphyry system transitioning outwards from a potassic core to peripheral argillic and distal propylitic alteration. In this setting, the bonanza-grade structures are interpreted to be intermediate- to high-sulphidation epithermal veins. Possible analogues to this style of mineralization are massive sulphide veins associated with certain large scale porphyry systems such as at Chuquicamata and Collahuasi, both located in Chile. There are also certain similarities to the veins previously mined at the El Indio mine further south in Chile and possibly the Victoria vein swarm associated with the Far Southeast porphyry deposit in the Philippines.

These observations and interpretations will guide the planning for our next drill program which will begin early in the fourth quarter of 2024 and continue to focus on exploration with an aim to determine the full size of the bonanza-grade vein system and exploring the potential for additional high-grade porphyry +/- high-sulphidation epithermal mineralization to the south, east, and west, while also starting to delineate the detailed geometry and continuity of the individual veins.

Drill Hole Details

DPDH017 was collared on Section 5875N, over 1 km east of the Lunahuasi deposit and drilled towards the east at -55 degrees to a final depth of 393m. This hole was designed to test an inferred, possibly mineralized, NE-trending structure along the eastern boundary of the Filo-Los Helados Structural Corridor. The hole intersected a few 2m sample intervals of just under 1% CuEq in narrow structures but did not intersect more extensive mineralization.

DPDH019 was collared on the top of the plateau approximately 750m above the collars of the other drill holes in this release, on Section 5950N and drilled towards the east at a dip of -61 degrees to a final depth of 1,391.6m. The hole largely cut distal alteration and pyrite dominated stockwork veining typical of the upper halo of the system and ended in a pyrite dominated stockwork zone above the elevation where stronger copper mineralization occurs in other holes. Gold and silver in particular were increasing toward the bottom of the hole with a number of 2m samples of higher grade intersected (e.g. 1,288m to 1,290m at 0.182% Cu, 0.904 g/t Au, 227.0 g/t Ag and 1,316m to 1,318m at 0.117% Cu, 0.684 g/t Au, 222.0 g/t Ag).

The alteration and mineralization in DPDH019 confirm the presence of a copper-gold porphyry system to the west of the current drill holes. Evidence for porphyry-type mineralization in this hole is provided by A- and B-type quartz veinlets occurring over a 398m interval between 520m and 918m as well as an intense stockwork of D-type veinlets (sericitic haloes around pyrite centrelines). These veinlets are dominated by either pyrite or specularite and contain minor magnetite, chalcopyrite and molybdenite. The 398m interval averaged 0.12% Cu, 0.17 g/t Au and 2.2g/t Ag.

The hole was ended due to rig capacity and the early onset of the winter weather conditions at Lunahuasi. Nonetheless, hole DPDH019 provided critical information that will allow us to effectively target the centre of the system in our next drill program.

DPDH020 was collared on Section 6200N and drilled towards the west at -55 degrees to a depth of 959m. The hole intersected overburden to 72.0m where it entered quartz diorite which shows a sharp change in alteration from propylitic to quartz-clay at 184.0m leading to the first mineralization at 204.0m. A long interval of closely spaced veins and veinlets continues to the end of the hole. Within this mineralized zone, several discreet high-grade veins stand out, as shown in the table above, including 17.3m at 5.94% CuEq from 589.8m, 1.0m at 24.88% CuEq from 660.5m and 8.0m at 8.81% CuEq from 802.5m.

The final 20m returned 0.90% CuEq (0.68% Cu, 0/19 g/t Au, 8.27 g/t Ag).

DPDH021 was collared on Section 5900N and drilled towards the west at -45 degrees to a depth of 1,205.5m. This is the southernmost hole drilled into the Lunahuasi deposit and establishes a minimum 400m strike length for the deposit, which remains wide open south of this hole.

The hole intersected 26m of overburden above quartz diorite bedrock which continued to the rhyolite contact at 496m. Rhyolite was intersected to the end of the hole, cut by a few andesite dykes. Alteration is a mix of propylitic and quartz-clay from the top of the hole, with the latter increasing with depth and becoming pervasive by 430m.

Mineralization starts to appear around 206m associated with sporadic zones of silicification and quartz-clay alteration, with a long homogeneous zone of near-continuous mineralization beginning at 430m corresponding to the change in alteration. As with the other holes, several discreet zones of bonanza-grade mineralization cut this section including 58.1m at 6.04% CuEq from 438.0m. Included within this interval is a 4.8m wide massive sulphide intersection at 480.5m which assayed 20.97% Cu, 24.34 g/t Au and 272.1 g/t Ag. Another massive sulphide zone at 614.0m returned 15.09% Cu, 4.27 g/t Au and 160.7 g/t Ag over 6.0m.

This hole was stopped in good mineralization due to rig capacity and the early onset of winter. The final 20m returned 1.32% CuEq (1.07% Cu, 0.25 g/t Au, 7.1 g/t Ag).

DPDH022 was collared on Section 5600N, from the same platform as DPDH018 (see news release dated May 9, 2024), and drilled towards the west at an angle of -45 degrees to a final depth of 1,106.5m. This hole is parallel to, and averages 100m away from, DPDH021 which allows for good correlation of geology and mineralized zones between the two holes.

Lithology in hole 22 was very similar to that in hole 21, with quartz diorite intersected to a depth of 466m and rhyolite from there to the end of the hole. Propylitic and quartz-clay alteration alternate to 343m where quartz-clay becomes pervasive, continuing to the bottom of the hole.

Scattered mineralized zones above the main zone of continuous mineralization are more well-developed here than in hole 21 with several zones noted between 178m and 275m. The main mineralized zone begins at 380m and continues to the end of the hole. The average grade of this long interval is remarkably similar to hole 21 – with 1.66% CuEq here compared to 1.60% CuEq in hole 21 – and is marked by slightly higher gold content (0.88 g/t compared to 0.64 g/t) and lower copper (0.89% compared to 1.02%).

This longer mineralized zone is again cut by several much higher-grade zones, including a 157.0m interval at 4.37% CuEq from 380.0m. This interval contains several higher-grade sub-intervals such as 38.9m at 10.84% CuEq from 408.0m. Gold values are particularly high within this sub-interval and include 3.0m at 24.10 g/t Au from 414.0m, 1.8m at 48.13 g/t Au from 427.0m and 2.3m at 48.60 g/t Au from 438.1m.

DPDH023 was collared on Section 6200N and drilled towards the east at an angle of -60 degrees to a depth of 254.0m. The hole was drilled in the opposite direction to the other holes to better understand the geometry of the mineralized structures.

This hole starts in a younger volcaniclastic sequence which unconformably overlies the main quartz diorite / rhyolite sequence at about 150m. A mix of rhyolite and quartz diorite affected by strong quartz-clay alteration continues from here to the end of the hole. Mineralization occurs primarily in five high-grade structures as shown in the table above. These correlate well with zones in holes DPDH010 and DPDH015 (see news releases dated January 8, 2024, February 21, 2024, and April 30, 2024).

This hole was suspended due to the early onset of the winter season and will be continued during the next drill campaign.

Table 2: Drill Hole Information

|

Hole ID |

East |

North |

Elev |

Azimuth |

Dip |

Length |

Status |

|

DPDH009 |

439040 |

6856277 |

4,683 |

263.59 |

-59.27 |

582.0 |

Completed |

|

DPDH010 |

439035 |

6856223 |

4,684 |

269.75 |

-55.08 |

1,070.2 |

Completed |

|

DPDH011 |

439090 |

6856275 |

4,658 |

270.22 |

-61.82 |

419.0 |

Completed |

|

DPDH012 |

439195 |

6856275 |

4,626 |

269.55 |

-57.95 |

704.0 |

Completed |

|

DPDH013 |

439090 |

6856224 |

4,663 |

272.42 |

-55.27 |

1,033.4 |

Completed |

|

DPDH014 |

439190 |

6856224 |

4,634 |

270.71 |

-55.63 |

976.8 |

Completed |

|

DPDH015 |

439040 |

6856224 |

4,682 |

268.77 |

-43.71 |

917.4 |

Completed |

|

DPDH016 |

439140 |

6856125 |

4,659 |

270.48 |

-46.03 |

772.7 |

Completed |

|

DPDH017 |

440255 |

6855875 |

4,542 |

134.97 |

-55.23 |

393.0 |

Completed |

|

DPDH018 |

439214 |

6856000 |

4,705 |

283.78 |

-44.24 |

1,167.4 |

Completed |

|

DPDH019 |

437555 |

6855951 |

5,358 |

069.83 |

-60.91 |

1,391.6 |

Completed |

|

DPDH020 |

439294 |

6856188 |

4,657 |

266.75 |

-54.55 |

959.0 |

Completed |

|

DPDH021 |

439222 |

6855912 |

4,743 |

265.30 |

-44.24 |

1,202.5 |

Completed |

|

DPDH022 |

439210 |

6855997 |

4,706 |

268.54 |

-43.84 |

1,106.5 |

Completed |

|

DPDH023 |

438852 |

6856212 |

4,777 |

079.61 |

-59.94 |

254.0 |

Completed |

Upcoming Webinars

The Company is hosting the following webinars to discuss the Lunahuasi drill results and provide a general corporate update.

Date: Wednesday, June 19, 2024, at 9:00 a.m. (Vancouver time)

Please click on the following link to access the webinar: NGEx Minerals Webinar

Passcode: 566039

Date: Friday, June 21, 2024, at 9:00 a.m. (Vancouver time)

Please click on the following link to access the webinar: NGEx Minerals Webinar

Qualified Persons and Technical Notes

The scientific and technical disclosure included in this news release have been reviewed and approved by Bob Carmichael, B.A.Sc., P.Eng. who is the Qualified Person as defined by NI 43-101. Mr. Carmichael is Vice President, Exploration for the Company.

Samples were cut at NGEx's operations base in San Juan, Argentina by Company personnel. Diamond drill core was sawed and then sampled in maximum 2-meter intervals, stopping at geological boundaries. Core diameter is a mix of PQ, HQ and NQ depending on the depth of the drill hole. Samples were bagged, tagged and packaged for shipment by truck to the ALS preparation laboratory in Mendoza, Argentina where they were crushed and a 500g split was pulverized to 85% passing 200 mesh. The prepared sample splits were sent to the ALS assay laboratory in either Lima, Peru or Santiago, Chile for copper, gold and silver assays, and multi-element ICP. ALS is an accredited laboratory which is independent of the Company. Gold assays were by fire assay fusion with AAS finish on a 30g sample. Copper and silver were assayed by atomic absorption following a 4-acid digestion. Samples were also analyzed for a suite of 48 elements with ME-MS61 plus mercury. Copper and gold standards as well as blanks and duplicates (field, preparation, and analysis) were randomly inserted into the sampling sequence for Quality Control. On average, 9% of the submitted samples are Quality Control samples. No data quality problems were indicated by the QA/QC program.

Copper equivalent (CuEq) for drill intersections is calculated based on US$3.00/lb Cu, US$1,500/oz Au and US$18/oz Ag, with 80% metallurgical recoveries assumed for all metals. The formula is: CuEq % = Cu % + (0.7292 * Au g/t) + (0.0088 * Ag g/t). True widths are estimated based on a preliminary geological interpretation and are subject to change as more information is acquired and the geological interpretation is refined.

NGEx Minerals is a copper and gold exploration company based in Canada, focused on exploration of the Lunahuasi copper-gold-silver project in San Juan Province, Argentina, and the nearby Los Helados copper-gold project located approximately nine kilometres northeast in Chile's Region III. Both projects are located within the Vicuña District, which includes the Caserones mine, and the Josemaria and Filo del Sol deposits.

NGEx owns 100% of Lunahuasi and is the majority partner and operator for the Los Helados project, subject to a Joint Exploration Agreement with Nippon Caserones Resources LLC, which is the indirect 49% owner of the operating Caserones open pit copper mine located approximately 17 kilometres north of Los Helados. Lundin Mining Corporation holds the remaining 51% stake in Caserones.

The Company's common shares are listed on the TSX under the symbol "NGEX" and also trade on the OTCQX under the symbol "NGXXF". NGEx is part of the Lundin Group of Companies.

Additional information relating to NGEx may be obtained or viewed on SEDAR+ at www.sedarplus.ca.

Neither the TSX nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy or accuracy of this news release.

The information contained in this news release was accurate at the time of dissemination but may be superseded by subsequent news release(s). The Company is under no obligation, nor does it intend to update or revise the forward-looking information, whether as a result of new information, future events or otherwise, except as may be required by applicable securities laws.

Certain statements made and information contained herein in the news release constitutes "forward-looking information" and "forward-looking statements" within the meaning of applicable securities legislation (collectively, "forward-looking information"). All statements other than statements of historical facts included in this document constitute forward-looking information, including but not limited to, statements regarding: the nature and timing of the work to be undertaken to advance the Lunahuasi Project, including the Company's ability to continue holes in-progress in a future drill program; the potential for further discovery and/or extension of mineralized zones at the Lunahuasi Project;; the timing of, and conclusions resulting from, an update to the geological interpretation at Lunahuasi; and the Company's ability to use information gathered from drilling to date to effectively target and drill in future campaigns, including whether the timing and ultimate outcome of the Company's efforts to locate the centre of the Lunahuasi system. Generally, this forward-looking information can frequently, but not always, be identified by use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "projects", "budgets", "assumes", "strategy", "objectives", "potential", "possible", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or statements that certain actions, events, conditions or results "will", "may", "could", "would", "should", "might" or "will be taken", "will occur" or "will be achieved" or the negative connotations thereof.

Forward-looking information is necessarily based upon various estimates and assumptions including, without limitation, the expectations and beliefs of management with respect to the nature, scope and timing of the work to be undertaken to advance the Lunahuasi Project. Although the Company believes that these factors and expectations are reasonable as at the date of this document, in light of management's experience and perception of current conditions and expected developments, these statements are inherently subject to significant business, economic and competitive uncertainties and contingencies. Known and unknown risks, uncertainties and other factors may cause actual results or events to differ materially from those anticipated in such forward-looking statements and undue reliance should not be placed on such statements and information. Such factors include, without limitation: the emergence or intensification of infectious diseases, such as COVID 19, and the risk that such an occurrence globally, or in the Company's operating jurisdictions and/or at its project sites in particular, could impact the Company's ability to carry out the program and could cause the program to be shut down; estimations of costs, and permitting time lines; ability to obtain environmental permits, surface rights and property interests in a timely manner; currency exchange rate fluctuations; requirements for additional capital; changes in the Company's share price; changes to government regulation of mining activities; environmental risks; unanticipated reclamation or remediation expenses; title disputes or claims; limitations on insurance coverage, fluctuations in the current price of and demand for commodities; material adverse changes in general business, government and economic conditions in Argentina; the availability of financing if and when needed on reasonable terms; risks related to material labour disputes, accidents, or failure of plant or equipment; there may be other factors that cause results not to be as anticipated, estimated, or intended, including those set out in the Company's annual information form and annual management discussion and analysis for the year ended December 31, 2023, which are available on the Company's website and SEDAR+ at www.sedarplus.ca under the Company's profile.

The forward-looking information contained in this news release is based on information available to the Company as at the date of this news release. Except as required under applicable securities legislation, the Company does not undertake any obligation to publicly update and/or revise any of the included forward-looking information, whether as a result of additional information, future events and/or otherwise. Forward-looking information is provided for the purpose of providing information about management's current expectations and plans and allowing investors and others to get a better understanding of the Company's operating environment. Although the Company has attempted to identify important factors that would cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. All the forward-looking information contained in this document is qualified by these cautionary statements. Readers are cautioned not to place undue reliance on forward-looking information due to the inherent uncertainty thereof.

Information concerning the mineral properties of the Company contained in this news release has been prepared in accordance with the requirements of Canadian securities laws, which differ in material respects from the requirements of securities laws of the United States applicable to U.S. companies subject to the reporting and disclosure requirements of the United States Securities and Exchange Commission.

SOURCE NGEx Minerals Ltd.